So, what can you do and what do you need to know if you think your property valuation is incorrect? A few things.

First, know that your property valuation going up doesn’t mean your tax bill will go up by the same amount. What matters is your property valuation change relative to everyone else.

Second, I want to be clear: if you appeal your valuation, there is a chance the property value on appeal will actually go up. So, I only recommend appealing for people who have some reason to believe (comparable sales, etc.) the valuation is wrong, or can show that something is factually wrong with the data on the home (ie wrong square footage)

Next: if you believe an error has been made, go to this website to file an informal appeal (deadline 3/1). If that doesn’t work out, you can then file a formal appeal (deadline 3/15). There is a video here you should watch.

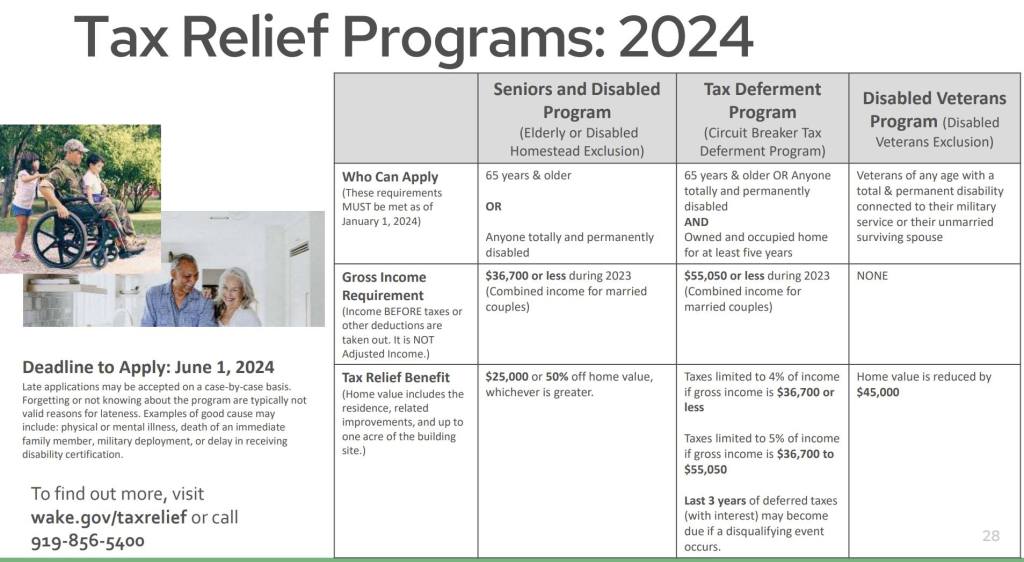

Finally, I want everyone to be aware of the tax relief programs available. Unfortunately we don’t have any control over this (they have to be uniform state wide, and are controlled by the state). But if you are 65 or older, have a disability, are a disabled veteran, and meet certain income requirements, you may be eligible for some tax relief or tax deferral. I included below the summary chart from the county of the programs available.